[ad_1]

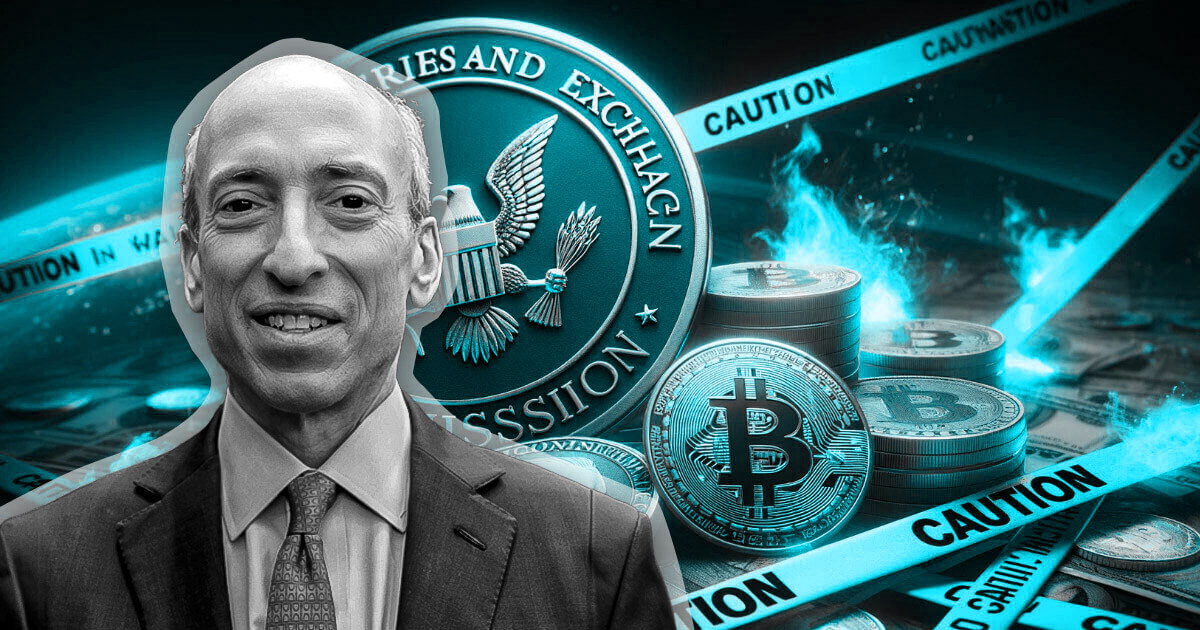

SEC Chair Gary Gensler said it is ironic that people call the approval of spot Bitcoin ETFs a historical moment considering its centralized nature, which is the antithesis of Satoshi Nakamoto’s vision.

He said:

“Think about the irony of those who say this week is historic. This [the approval] was about centralization and traditional means of finance.”

Gensler made the statement during a CNBC “Squawk Box” interview on Jan. 12, where he delved into the reasons behind the SEC’s approval and addressed some of the concerns raised by Senator Elizabeth Warren.

Respecting the courts

Gensler said that the SEC approved the 11 spot Bitcoin ETFs due to the recent court decision in the regulator’s lawsuit against Grayscale. The court ruled that the SEC did not have legitimate grounds to reject a spot Bitcoin ETF since it had approved products based on futures for the flagship cryptocurrency.

Gensler said that the SEC has the utmost respect for the law and will always follow the court’s directives regarding regulation. He added that the approval of the ETFs does not equate to an endorsement of Bitcoin, and he continues to hold a critical stance toward the asset.

According to the SEC chair:

“Bitcoin itself we did not approve, we do not endorse. This is a product called an exchange-traded product that investors can invest in the underlying non-security commodity asset.”

He added that Bitcoin remains a “volatile store of value” that is not being used for any legitimate payments. However, he acknowledged that the underlying technology holds promise and that approving the ETFs was the “most sustainable path forward.”

Gensler also clarified that Bitcoin is the only cryptocurrency it considers a non-security commodity, likening it to gold and silver-based products. He added that the regulator continues to hold the view that the majority of crypto tokens are securities.

Response to Warren

Gensler’s remarks also touched upon Warren’s criticism of the decision. The senator has been a vocal critic of the cryptocurrency market, arguing that the SEC’s approval was legally and policy-wise erroneous.

Responding to these concerns, Gensler expressed respect differing opinions but reaffirmed his commitment to following legal and court directives. He stated:

“While I understand and respect the concerns raised by Senator Warren, our decision is grounded in a rigorous consideration of the legal framework and the current financial realities.”

Despite the controversy surrounding the SEC’s decision, the approval of these Bitcoin ETFs signifies a potentially new era for cryptocurrency in the mainstream financial market.

The inaugural trading session following the approval witnessed significant activity, indicating strong investor interest and potentially paving the way for more widespread acceptance of digital assets.

[ad_2]

Source link

Leave a Reply